Adulting 101: How To Get Your Pag-IBIG Fund Housing Loan Approved (Part 1)

TL;DR

If you're here to see if a freelancer or a virtual assistant can apply for loan, then the short and direct answer is YES! And thanks for dropping by my blog, so I hope my story will help you in your research to apply for a loan and eventually get approved.

What is a Pag-IBIG Fund Housing Loan and who can get it? Simply put, it is a special program that helps people buy their own house. Pag-IBIG is short for Pagtutulungan sa Kinabukasan: Ikaw, Bangko, Industriya at Gobyerno (O diba? See what a simple Google search can do?) and it just means helping each other for the future basically.

To get the loan, you need to follow certain rules, like being a member of Pag-IBIG Fund and having enough money saved up. If you follow the rules and get approved, you can buy your dream house and pay for it over a long time. Simple right? Well, not really. I'll explain it as best as I can and share with you my personal experience, which is very positive, by the way.

So, this is not a blog to bash them or anything, but I'd like to help you (who is reading this blog) because I feel like some people need some clarifications, and it could save you time as well when preparing your documents. Di lalim mag balik2x ug mag linya2x sa mga opisina ha!

Anyway, I am so glad I agreed to avail myself of the Pag-IBIG membership when I was still employed by a local company and since it was a very minimal deduction from my salary. I never thought I would use it really, but (never say never!) you really need to have a contribution to qualify for a loan from Pag-IBIG. For more of the Eligibility Requirements, check their official website.

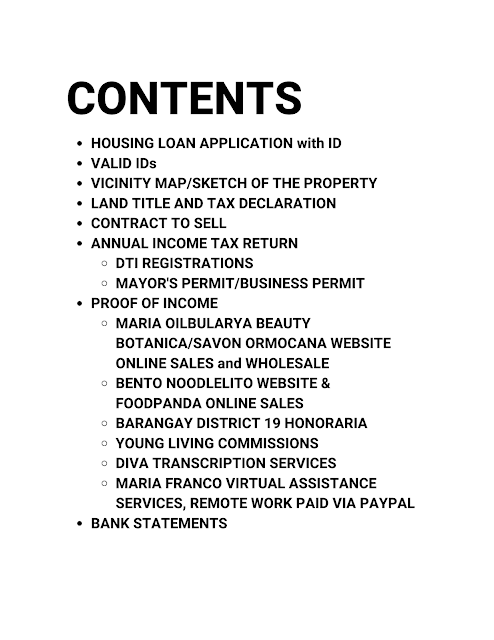

Now, let's talk about the *ACTUAL* Loan Application Process and my journey. The documents to prepare are already listed on the website, but it was very helpful to speak with a Pag-IBIG staff to really know what you need. There are things that need to be the original copies, while some are fine with just photocopies. I can't even count the number of times I went to city hall just to secure those certified true copies, but it is what it is.

I just wished the government agencies in my city are closer to each other, ahem, BIR, why are you located so far??? I can just imagine the plight of other people who need to commute. I'm thankful I get chauffered around, because why not chocnut? I don't mean to brag but honestly, I don't like to drive anymore so I like having people take me places now. *signs of aging* Also, parking can be a nightmare... literally.

Around March 2022, I started preparing my documents according to the website's instructions. It took me a while to secure everything because of tax documents as a freelancer/business owner/self-employed/mixed-income earner/Jill of All Trades. They say it's easier as an employee actually because all they need is their employer to help them with the docs.

Eventually, around August 2022, I finally submitted all my papers. But only after I was given another list of documents to submit by a super helpful Pag-IBIG staff (shoutout to Sir Arvin for always being so accommodating!!!). Remember: you need to submit TWO (2) FOLDERS, so it was like TWO (2) copies of everything. I literally finished a ream of bond paper printing all my stuff.

My approved loan amount was reduced to match my capacity to pay for it. Well, duh, obviously. So, if you can provide as much source of income as you can, do it. That's why I really suggest freelancers and online/remote workers pay taxes properly. Things will boil down to your annual income tax return (ITR). But let me tell you the good thing about applying for a loan as a virtual assistant or freelancer. You just need a certificate of engagement or employment from your client/boss stating your salary/compensation per month. A Pag-IBIG staff is going to verify that with them via email. They won't call internationally, so don't fret. They just need to send a quick email reply back. That's it, pancit. Just give your boss, finance team, or HR the heads up to expect the email.

The application process will take around 20 working days. It's in their citizen's charter, and they're very stringent about it. They also email you constantly for updates, which is pretty cool and assures you that things are getting done. By September 16, 2022, I got an email of DISAPPROVAL. Boom! But wait, they will give you 30 days to comply with the missing documents or whatever you need to submit.

Well, I ran into an issue of missing monuments in the sketch plan and regarding the title of the lot because they needed a subdivision plan attached to it. So, we had to drive all the way to Tacloban to the Bureau of Lands that wasn't able to help. (Shout out to Engr. Mark of Pag-IBIG, who was in charge of inspecting the lot/property and walked us through how to get the subdivision plan!).

Eventually, we had to ask our neighbor (who happens to also be our geodetic engineer!) to help us and he asked his friend from the Malaking Lupa to go to the Land Authority to secure the document. Ugh. That was unexpected but needed. So, prepare to shell out some extra because some of the documents you need to submit come with a price, maybe calling in some favors, and a helluva leg work!

Now, after completing and submitting the other required documents on October 3, 2022, I finally received the Notice of Approval on October 19, 2022. Yayyy! See? That didn't take long as long as you got everything completely and correctly prepared/submitted! But then, the real arduous journey began. Now, there were quite a number of paperwork that had to be secured, which involved notarized copies, certified true copies, and all that jazz. Pag-IBIG Fund will give you 90 days to comply. Considering there were holidays in December, so by January, I had to request an extension which was granted until March 17, 2023.

So, why wasn't 90 days enough? Seems like a long time to get ready. Well, let me tell you why. My BIR experience was like going to hell and back. Long story short, it took 4 weeks just to get my capital gains tax sorted and my Certificate Authorization Registration (CAR) to be released! So, that the guy in charge who received my folder of documents took a week off, traveled for a seminar, told me his grandma died (may she rest in peace!), and then lost my damn folder. So, I had to procure documents back to square one! Que horror!

The amount I paid to process everything, by the way, was also no joke. It went well into the 6 figures, but this tax would also depend on how much you purchase the lot. (Note: Whenever I say, "I did this or I did that," this is with the consent of my husband because, after all, the loan includes your spouse, if you're married, as the borrower!).

I based the amount in our Deed of Sale on the approved Pag-IBIG Fund Housing Loan amount to keep things simple. But that's just me because I hate Math, which is still the bane of my existence. The back-and-forth travel between the attorneys/lawyers, City Hall (Registry of Deeds & Assessor's Office), the banks, and BIR Office is something you need to brace for. And waiting in line... (Shoutout to Liny for doing all the follow-up for me when I couldn't!)

Oh, in case you're wondering, my parents are the sellers of the lot. So, technically, I took a housing loan from Pag-IBIG Fund to buy a lot from them. You really didn't have to know that, but just in case you're asking why I may have gotten the lot cheaper also when, in fact, the value is actually twice the amount I bought it for.

All right, moving on. When all the required documents were sent to Pag-IBIG Fund, the check for the Purchase of a Fully Developed Lot was then endorsed to the branch office on March 10, 2023. My parents picked it up a few days later when it was ready, and I have just started paying for the monthly amortization, which is basically feels like renting to own. To me, rather than renting a place, why not buy and pay in installments or terms, right?

By the way, I applied for 25 years with 3 years re-pricing period. My cousin who took out a housing loan for a 20-year term pays her monthly amortization but adds extra to pay against the principal amount, which is something we can actually do if we have extra cash so that we can pay off the loan quicker. So, there it is, folks. My journey to get the Pag-IBIG Fund Housing Loan approved is done... Part 1, at least.

Stay tuned for Part 2...

Tips to Increase Chances of Approval

Story Time!

Once upon a time, there was a young couple who were looking for a new home to start their family. They decided to apply for a housing loan from Pag-IBIG Fund. However, they were worried about getting their loan approved.

They knew that they needed to follow some important tips to increase their chances of approval. They made sure to maintain a good credit score by paying their bills on time and keeping their credit card balances low.

They also made sure to have a stable source of income. They made sure to save money and not spend too much on unnecessary things. In addition, they chose a property that met the loan requirements. They made sure to purchase a house and lot within their budget and met all the requirements set by Pag-IBIG Fund.

The couple was very diligent in following the loan application process. They submitted all the required documents on time and made sure to follow up with Pag-IBIG Fund to make sure their application was being processed.

They sought the help of employees and staff who can give valuable advice on how to improve their chances of getting approved and guided them throughout the application process. Thanks to their diligence and hard work, the couple was eventually approved for their housing loan.

The end.

Bottomline: I got approved for the loan as a freelancer and/or virtual assistant, so you can do it, too!

If you're looking to buy your own home but don't have enough money to pay for it in full, a housing loan from Pag-IBIG Fund could be the solution for you!

With a housing loan from Pag-IBIG Fund, you can finally buy the home of your dreams without having to worry about paying for it all at once. Instead, you can pay for your home in small, manageable installments over a long period of time.

What's more, Pag-IBIG Fund offers some of the lowest interest rates in the market, making it an affordable option for anyone looking to buy a home. Plus, if you're a member of Pag-IBIG Fund and have been contributing regularly, you may be eligible for a housing loan with even lower interest rates!

So, don't let your dream of owning a home slip away. Pursue a housing loan with Pag-IBIG Fund and take the first step towards making your dream a reality. With the right attitude, diligence, and adherence to the requirements and guidelines, you'll surely have a greater chance of getting your loan approved.

Just remember to maintain a good credit score, have a stable source of income, choose a property that meets the loan requirements, follow the loan application process diligently, and seek the help of a loan specialist or staff. With these tips in mind, you can increase your chances of getting your housing loan approved and finally enjoy the comfort and security of your own home!

.png)

.png)

.png)

3 Comments

what exactly the long term personal loans is and how its works is given in this blog.

ReplyDeleteIn need of quick financial assistance? Look no further than Ramfincorp! Our fast and reliable services provide you with the quick personal loan you require, ensuring your financial peace of mind. With our user-friendly process, you can secure the funds you need within no time. Whether it's for unexpected expenses or a well-deserved treat, trust Ramfincorp to make it happen. Apply now for hassle-free, speedy loans!

ReplyDeleteFinancial problems can occur without warning and in such moments having instant personal loans can be convenience. Online personal loans through Creditmitra involve simple and speedy loan applications, effortless approvals and minimal verification of documents.

ReplyDeleteYou will be able to use only your smartphone and the application from Creditmitra to submit a personal loan application. Such instant loan applications and tools are planned in a way that the fund is placed in the customer's account within hours making them quite handy for immediate use.

While most people look up for emergency loans on the internet, in Creditmitra it takes only a few minutes to apply for a personal loan online from anywhere in India or anywhere. Creditmitra platform assists in availing of personal loans in India regardless of whether one stays in a metro city or a small town.